Buying your first home can be an exhilarating experience, but it’s also one that should be well-planned to avoid unpleasant surprises. It’s wise to examine your finances to ensure that you not only have enough funds to make monthly mortgage payments but also cover closing costs. You’ll need to pay for most closing costs when you close on the home, although some expenses may have to be covered before this time.

What Specific Fees are Included in Closing Costs?

What Specific Fees are Included in Closing Costs?

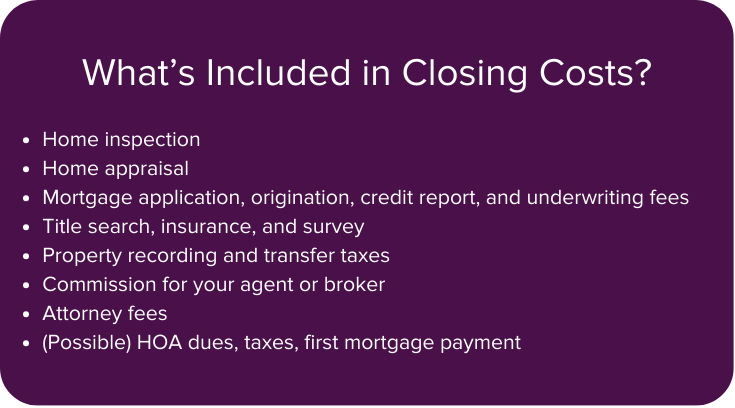

Closing costs fees include lender fees and third-party fees. Mortgage loan lenders typically charge an origination fee, application fee, underwriting fee, and credit report fee to cover the cost of processing your loan. Furthermore, your lender will require a down payment on the property in accordance with the terms you agreed to when you took out the loan.

There are also insurance premiums. You’ll need to pay for at least part of your home insurance policy upfront. You may be required to pay part of the property tax bill upfront as well. If you close on a home before the end of the month, you’ll need to pay that month’s portion of the mortgage payment.

If you work with a real estate agent, you will need to pay their commissions. You’ll need to pay a real estate lawyer if you hire one during the home purchase process. You’ll need to pay for the appraisal of the property if you haven’t already done so. If the property doesn’t have a valid survey, you’ll need to pay for that, too. You’ll also need to pay title company fees. These fees cover the cost of having a title company check the home title to make sure no one else has a legal claim on the home you want to buy. There are also HOA fees if you live in a neighborhood that has a homeowner’s association.

How Much Can Closing Costs Typically Amount To?

Closing costs vary depending on the lender you work with, your chosen mortgage loan type, the cost of the property, and many other factors. These costs, which do not include the down payment fee, can range between 1% and 5% of the total home purchase price.

Most of the closing costs are paid to your lender. The loan origination fee, for instance, can be up to 1% of the total loan amount. The average processing fee for a loan is $450 and the average underwriting fee is $500. Your escrow deposit, which includes upfront property taxes and mortgage insurance payments for two months, will likely cost thousands of dollars. Title insurance, which is paid to the title insurance company, costs an average of $500. An appraisal costs between $500 and $1,000, while a survey will cost at least $400. Lawyer fees come to at least $400. The average HOA fee is $170 per month.

Who is Responsible for Paying Closing Costs, the Buyer or the Seller?

The closing costs listed above are the buyer’s responsibility. The seller has other closing costs he or she has to cover, and these costs are significantly higher than the buyer’s closing costs. Sellers must pay about 6% of the total sale price to cover the listing and buyer’s agent’s commission fees, in addition to other fees and taxes. However, some sellers may be willing to cover some of the buyer’s closing costs as part of the home sale deal.

Are There Ways to Reduce or Negotiate Closing Costs?

The first step to take in reducing closing costs is to do comparison shopping when taking out a mortgage loan. Ask various lenders for their rates, closing costs, and fees. You can also ask the lender if there is room to reduce some fees or even eliminate them altogether. You’ll want to take the same approach when shopping for home insurance; however, bear in mind that your lender will have policy requirements that you need to meet no matter which insurer you pick.

If the seller is motivated, he or she may be willing to cover some of your closing costs. Ask about this possibility when negotiating the cost of the home. You can also increase the odds of having the seller cover some costs if you’re willing to make some concessions. For instance, you could allow the seller extra time to move out of the home or waive your right to a home inspection in order to speed up the sale process. Alternatively, the lender may agree to cover some closing cost fees if you’re willing to pay a bit extra for the house.

Alternatively, you can ask your lender to roll your closing costs into your loan. If the lender agrees, then you won’t have to pay closing fees upfront. Bear in mind, however, that this move doesn’t reduce your closing costs. Rather, it increases them as you’ll have to pay the fees plus interest. If you want to keep costs low, it’s best to pay the fees upfront; however, if you can’t afford to do so, then rolling them into the loan will allow you to pay them off over an extended period of time.

How do Closing Costs Differ by Region or Type of Loan?

How do Closing Costs Differ by Region or Type of Loan?

State housing agencies offer closing cost assistance to eligible homebuyers, but the amount and type of aid you can get varies by state. In some states, such as Kentucky, Wyoming, Utah, and Massachusetts, successful applicants receive a low-interest rate loan to cover closing costs. Other states, such as Virginia, Vermont, Rhode Island, and Oregon, offer grants that you don’t have to pay back. Furthermore, since closing costs are based on a home’s sale price, individuals who purchase a home in a state with high home prices will have to pay higher closing costs than new homeowners who buy a house in a state with low home prices.

The mortgage loan you take out will also determine how much you’ll pay in closing costs. You don’t need to make a down payment if you take out a USDA loan. If you take out an FHA loan, you’ll need to pay 3.5% of the loan as a down payment. Conventional mortgage loan holders, on the other hand, need to pay between 3% and 5% of the loan as a down payment. If you buy a home from HUD, you can get financial help with closing costs such as listing and buyer’s agent fees. Veterans who take out a VA loan can likewise get financial assistance to cover certain closing costs.

What Should Homebuyers Prepare for in Terms of Timing and Payment of Closing Costs

When you evaluate your budget before you buy a home, it’s a good idea to estimate that you’ll need to pay 6% of the home’s total price in closing costs. If you’re able to get some fees reduced or waived, you’ll have extra cash on hand for your move. If not, you’ll have the funds you need to close on your new home.

You should also expect to pay at least some closing costs before you actually close on the home. Your lender will need a home appraisal in order to process the loan application. You’ll also need a survey of your new property so the title company can verify that the property you’re considering does indeed belong to the current owner. Since not all owners have a property survey, you may need to pay a survey company for one upfront. If you hire a home inspector to check out the house before you buy it, you’ll need to pay his or her fees before the inspection.

Inspire Home Loans® is the affiliate lender for Century Communities. Our team has years of experience helping buyers from all walks of life get the financing they need to buy the home of their dreams. Get in touch with us to find out more about our services or to start the process of financing your new home.